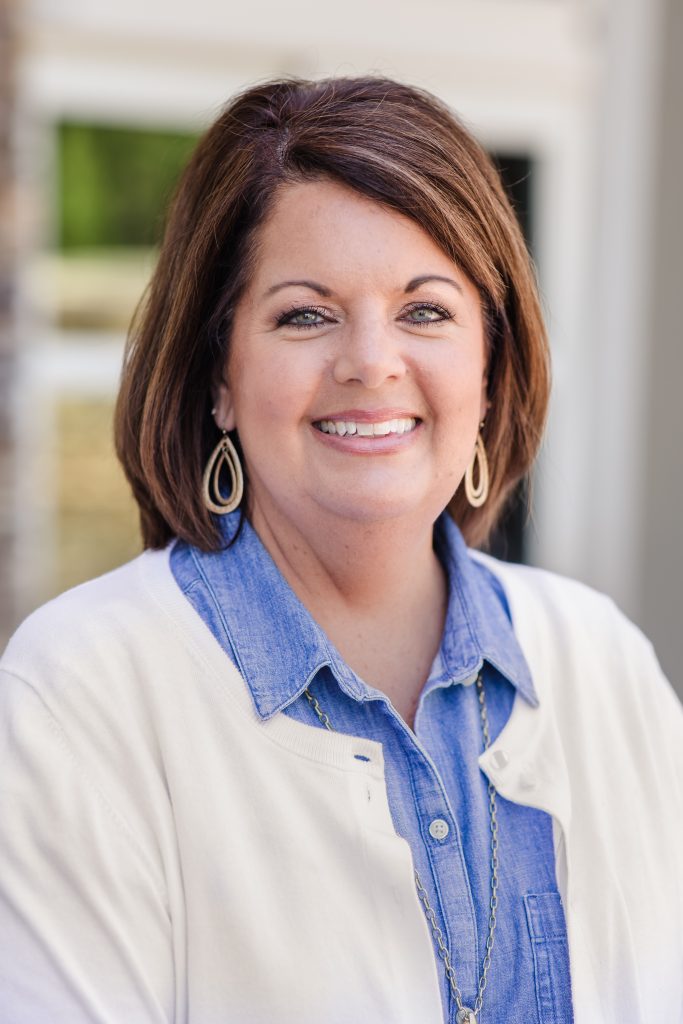

Photo Andy Calvert

The global pandemic and shifting economic framework has many people feeling uneasy. For some, the pressures of reduced work hours or unemployment leave them feeling downright frantic. Compounding the situation is the lack of viable child care and day camps, making the opportunity to job search or change careers next to impossible. We turn to Jennifer Selman, Vice President of Sales and Marketing at River City Bank for advice during these difficult times, and she offers us some insight on how best to allocate the economic impact payment from the Treasury Department.

The Federal government is providing financial relief for Americans struggling through this pandemic; eligible individuals receive $1,200, qualified married couples $2400, and $500 per child. “For many struggling families, $1,200 is a lot of money,” Selman explains. Properly distributing the economic impact payment can mean all the difference between success and failure during these difficult times. Selman gives a six-step guide to help with the burden of financial strain during the crunch of Covid-19. In truth, these tips are good straight forward advice for any functional family financial plan.

Step 1: The first step in any effective financial plan is setting a budget. If you don’t have a budget defined based on your income, set one. Be sure to incorporate your stimulus money into this budget.

Step 2: The second priority is to cover all necessary expenses such as a mortgage, rent, and utilities. This is an excellent opportunity to assess what expenditures can be left out of the budget until everything gets back to normal.

Step 3: Many families have had to rely on credit cards to cover expenses during the pandemic. When prioritizing payments, look to pay down your higher interest credit cards first. This will help ease the impact of interest charges against your budget over time.

Step 4: Try to stretch your funds as much as possible. This may seem obvious, but in truth, we do not know when the pandemic will be over. Businesses are just now starting to open back up, but many are still out of work or working reduced hours. Finding creative ways to stretch your income could mean all the difference. Shopping sales, using coupons, and repurposing household items are smarter ways to consume.

Step 5: Living paycheck to paycheck is the reality for a majority of Americans. It is crucial however, to establish an emergency savings account if you do not already have one. A good rule of thumb is to have enough to cover six months of expenses. Setting aside even a small amount each month will get you closer to this goal. Any extra that you are able to put away can be used for home improvements or vacation.

Step 6: At the end of the day, everyone should do what is adequate for their family and their economic situation, but be smart and deliberate with their spending.

Selman mentions, “Most of us probably never thought we would live to see an actual global pandemic- much less live through one. This is all new territory, given how the Coronavirus pandemic has affected our country. The Federal government has provided financial relief for struggling Americans.” These tips will help stretch these stimulus funds, as well as help advise families to plan for an uncertain future.